Mar 9, 2025 /Level: Beginners /Avg reading time: 6 minutes

Day trading crypto in 2025 offers incredible opportunities, but the high volatility and complexity of the ever-evolving digital asset market can be a minefield for the unprepared day trader. The cryptocurrency market’s 24/7 trading volume regularly exceeds $150 billion – according to CoinMarketCap data. This makes day trading cryptocurrency a potentially lucrative, yet inherently risky, endeavor. For beginners, day trading crypto offers a thrilling opportunity to capitalize on the extreme price volatility of cryptocurrencies like Bitcoin, Ethereum, and emerging altcoins.

This beginner’s guide to cryptocurrency trading in 2025 will walk you through the essentials: mastering strategies, leveraging cutting-edge tools, and navigating risks to thrive in the fast-paced world of crypto day trading.

This guide covers both the fundamental principles and advanced strategies needed to trade cryptocurrency effectively.

What is Day Trading Crypto?

Day trading cryptocurrency involves buying and selling digital assets within the same trading day, with the goal of capitalizing on short-term price movements in the crypto market. Unlike long-term investing strategies where positions in the stock market might be held for months or years, crypto day traders typically close all positions before the end of their trading session, rarely holding positions overnight.

The Fundamentals of Cryptocurrency Day Trading

Day trading crypto requires understanding several key concepts:

- Market volatility: Cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and altcoins experience significant price fluctuations within short timeframes, creating profit opportunities every minute of the day.

- Technical analysis: Successful crypto day traders rely heavily on candlestick charts, chart patterns, technical indicators, and trading volume to decide whether they should buy or sell.

- Risk management: Setting stop-loss orders and taking profits at predetermined levels helps protect capital in the highly volatile crypto markets.

- Trading platforms: Crypto exchanges like Binance, Coinbase Pro, and Kraken offer the tools day traders need to execute strategies efficiently.

Is Day Trading Crypto Right for You?

Yes, day trading cryptocurrency requires dedication and perseverance, but for those who approach it with the right mindset – focused on education, practice, and disciplined execution – it offers a uniquely accessible path to potential financial independence in the digital age. Here are some encouraging aspects of crypto day trading that might make it right for you:

Cryptocurrency’s volatility—often seen as a drawback—actually creates abundant trading opportunities. While traditional markets might move 1-2% on an active day, major cryptocurrencies frequently see 5-10% swings, providing more chances to profit from these price movements.

The average annual income of a day trader ranges between $68,000 and $198,000, with an average of $116,000, depending on the trading strategy and capital availability.

The barrier to entry is remarkably low. You can start with a small amount of capital, sometimes as little as $100, and gradually increase your position sizes as your skills improve and confidence grows.

How to Start Day Trading Crypto Successfully (Step-by-Step)

There is no guaranteed formula for successfully day trading cryptocurrency, but you can increase your chances of success if you follow a structured approach. In the world of trading psychology, many experts emphasize that you need to identify your personal trading style and temperament, then build trading strategies that align with your natural tendencies. Master the fundamental components of trading, including technical analysis, risk management, and trading psychology.

Let’s break down the essential steps to begin your crypto day trading journey effectively.

6 Tips to Know Before You Start Day Trading Crypto

Step 1: Learn the Basics

Before risking a single dollar in the crypto markets, dedicate significant time to understanding both the assets and the trading environment. Resources like exchange learning centers, trading books, and reputable online courses can accelerate your education:

- Candlestick Patterns: Master the interpretation of candlestick patterns, which provide visual representations of price action and market trends.

- Order Types: Understand the different order types, including limit orders, market orders, and stop-loss orders, and how to use them effectively.

- Technical Indicators: Familiarize yourself with key technical indicators like Moving Averages, RSI, and MACD.

Step 2: Develop Your Chart Reading Skills

While the random nature of markets remains a subject of debate (as illustrated by the ‘Random Walk Theory’), many traders operate on the premise that all markets exhibit repeatable, tradable patterns.

For day trading specifically, focus on mastering:

- Candlestick patterns and what they reveal about market psychology

- Support and resistance levels that tend to influence price action

- Key technical indicators that align with your trading style

- Volume analysis to confirm trend strength and potential reversals

Step: 3 Select Your Trading Timeframes

Crypto day traders typically concentrate on shorter timeframes, such as the hourly chart (candles representing one hour of price action), or as brief as 1-minute candlesticks. This approach enables traders to potentially profit from minor market fluctuations over short periods, aligning with their strategy of targeting frequent, modest gains. Many successful traders also incorporate data from higher timeframes, such as the daily or weekly charts, to support their short-term decisions. For example, if Bitcoin (BTC) or Solana (SOL) is showing a clear uptrend on the daily timeframe, trades taken in the same direction on lower timeframes may have a higher probability of success.

Step 4: Implement Rigorous Risk Management

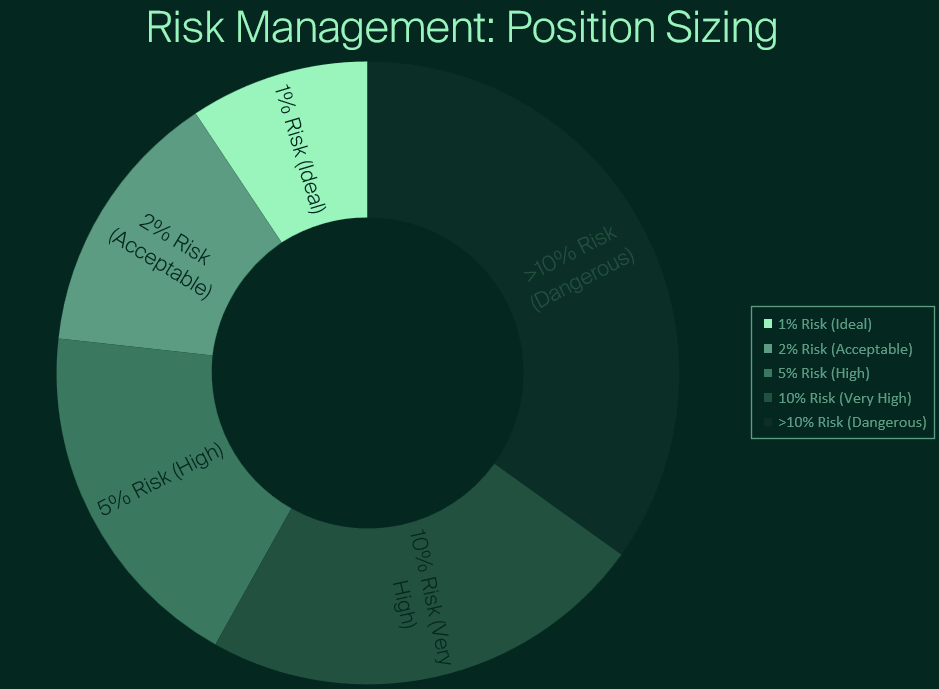

Risk management is arguably the single most important factor in day trading success. Even the most accurate trading strategy will fail without proper risk controls. To minimize your risk of ruin, consider implementing these practices:

- Set strict position sizing rules – Many professional traders never risk more than 1-2% of their total trading capital on a single trade.

- Always use stop-loss orders – Define your exit point before entering any trade.

- Maintain a positive risk-reward ratio – Aim for potential profits that are at least 2-3 times your potential loss.

Potential Outcomes (10 Consecutive Losing Trades)

| Risk Per Trade | Account Drawdown | Recovery Required |

| 1% Risk | 9.60% | 10.60% |

| 2% Risk | 18.30% | 22.40% |

| 5% Risk | 40.10% | 67.00% |

| 10% Risk | 65.10% | 186.50% |

Step 5: Don’t Start Day Trading Crypto with a Small Account

There is a persistent myth in the cryptocurrency trading world that you can start with just a few hundred dollars and grow it into substantial wealth through day trading. While theoretically possible, the reality is far more challenging – especially in cryptocurrency markets. When trading with a small account (under $5,000), the numbers simply don’t work in your favor. Consider these practical limitations:

Proper risk management dictates risking only 1-2% of your capital per trade. With a $500 account, this means risking just $5-10 per position – an amount too small to generate meaningful returns even when you’re right.

Perhaps more damaging than the mathematical challenges are the psychological pressures created by undercapitalization. Trading with insufficient funds creates an urgency to “grow the account quickly,” leading to excessive risk-taking, poor decision-making, emotional decisions, FOMO, overtrading, etc. This is where we address the biggest challenge for aspiring crypto day traders: lack of sufficient capital.

Step 6: The Prop Trading Solution

This is where proprietary trading firms (prop firms) like Leveraged come in. Prop firms provide capital to traders who can demonstrate consistent profitability in a simulated environment. Here’s how it works:

- The Simulation (Challenge): You trade in a simulated account, following specific rules and risk parameters. This tests your trading skills without risking your own money.

- Demonstrate Proficiency: If you meet the profit targets and adhere to the prop trading rules, you pass the simulation.

- Funded Account: The prop firm provides you with a funded account (significantly larger than what most beginners could afford) to trade with their capital.

- Profit Split: You keep a significant portion of the profits you generate (at Leveraged, it’s 80%). The firm takes a smaller share to cover their risk and operational costs.

Stop letting the lack of trading capital hold you back and start your Leveraged simulation today.

5 Popular Crypto Day Trading Strategies

Several strategies have emerged as particularly effective for day trading cryptocurrency:

- Scalping: This strategy involves making numerous trades throughout the day, capitalizing on minimal price movements and aiming for small but consistent profits.

- Range Trading: Traders identify support and resistance levels where cryptocurrencies tend to reverse direction, buying at support and selling at resistance within established price channels.

- Breakout Trading: This approach focuses on entering positions when crypto prices break through established support or resistance levels, potentially signaling the start of a new trend.

- News-Based Trading: This strategy capitalizes on market reactions to significant announcements like regulatory developments, technological upgrades, or corporate partnerships. Crypto markets often respond dramatically to news events, creating profitable trading opportunities for those who can act quickly.

- Arbitrage Trading: This approach exploits price differences for the same cryptocurrency across different exchanges. Because crypto markets are still relatively fragmented, price discrepancies frequently occur, allowing traders to buy on exchanges where prices are lower and sell where they’re higher.

Case Study: Profitable Crypto Day Trades in 2025

To illustrate effective crypto day trading strategies in action, let’s examine a real-world example that demonstrates the key principles successful traders employ and the thought processes behind day trading Bitcoin.

Example: Breakout Trading on BTC/USD

On March 2, 2025, Bitcoin had been consolidating in a tight range between $83,560 and $86,520 for approximately 48 hours, forming a classic rectangle chart pattern on the 15-minute chart. Entry Trigger: Volume began increasing significantly as price approached the upper resistance at $86,520. When price finally broke through with a large green candle accompanied by 8x average volume, our trader entered at $86,520.

Risk Management: A stop-loss was placed just below the previous consolidation zone at $83,560, risking approximately 2% of account value. As momentum continued, the trader used a trailing stop method, moving the stop-loss up to break-even once the position showed 1:1 risk-reward. When the price reached $90,000, they took partial profits on 50% of the position.

Exit: The remaining position was closed at $94,000 when the RSI indicator reached overbought readings, signaling weakening momentum. This trade yielded a 3.7% gain on the total position in just under 2 hours, representing a risk-reward ratio of approximately 1.85:1.

Key Lesson: Patience in waiting for confirmation of the breakout with increased volume prevented premature entry and potential false breakout losses. This type of professional-level trading becomes much more feasible when working with a prop firm like Leveraged, where traders can apply proper position sizing and risk management principles thanks to access to substantial capital.

Common Day Trading Mistakes to Avoid

Even experienced crypto day traders can fall victim to common pitfalls that can lead to significant losses. Being aware of these mistakes is the first step toward avoiding them:

- Overtrading: The 24/7 nature of crypto markets creates a false sense that opportunities are always available. This, combined with the dopamine hit from trading activity, leads many traders to force entries when quality setups aren’t present.

- Neglecting Risk Management: The volatile nature of cryptocurrencies can create overconfidence during winning streaks, leading traders to gradually increase position sizes or ignore stop-loss disciplines.

- Ignoring the Broader Market Context: The complexity of monitoring multiple markets creates a tendency to narrow focus to a single trading pair, cryptocurrency or indicator.

- Failure to Adapt to Changing Market Conditions: Day traders become comfortable with particular strategies that worked during specific market conditions and fail to recognize when those conditions change.

Ready to overcome the trading capital hurdle and accelerate your crypto day trading journey?

Don’t let a small account limit your potential. Leveraged offers you the opportunity to prove your skills, access significant capital, and benefit from expert guidance and AI-powered tools.

Click the button below and take the Leveraged Simulation today!

FAQs

Is day trading crypto legal in 2025?

Day trading cryptocurrency is generally legal in most major jurisdictions as of 2025, but regulations vary significantly from country to country. Crucially, it’s your responsibility to understand and comply with the specific laws and regulations in your location. Look for official government websites and regulatory bodies (e.g., the SEC in the United States, the FCA in the UK, FINMA, etc.) for the most up-to-date information.

What’s the minimum capital to start day trading crypto?

The minimum capital required to start day trading crypto varies between $1000 and $10,000. Technically, you can start with as little as a few dollars on some platforms, but this is highly discouraged for serious day trading. This is why many aspiring traders choose to partner with a prop firm like Leveraged to access larger capital.

Which crypto is best for day trading in 2025?

Bitcoin (BTC) often presents a compelling case for day traders in 2025 due to its unique combination of liquidity, volatility, established infrastructure, and market dominance.

How do taxes work for crypto day traders?

Tax laws for crypto day traders vary significantly by country, but in most jurisdictions, cryptocurrency is treated as property, not currency. This means that every trade you make (buying, selling, or exchanging) is a taxable event.