Mar 3, 2025 /Level: Beginners /Avg reading time: 8 minutes

Trading psychology for beginners is all about understanding the mental game and emotions behind buying and selling securities (stocks, commodities, forex and cryptocurrencies). These trading psychology tips focus on the emotions and habits that can make or break your success in the markets. From developing trading discipline to overcoming FOMO, it’s about mastering the traders mindset that separates winners from the majority of traders.

Why does this matter?

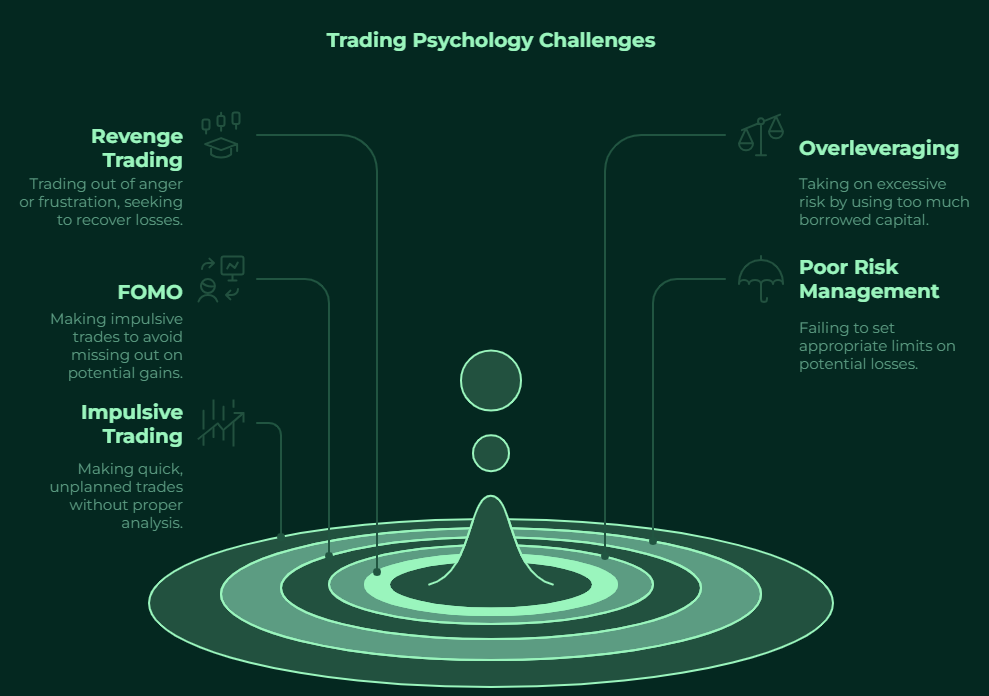

Because even with the right trading strategy, your emotions can trip you up. Fear, greed, hope, and regret – these feelings can cloud your judgment and lead to costly trading mistakes like:

- Revenge trading,

- Overleveraging,

- FOMO (fear of missing out),

- Not using stop loss order,

- Trading without a plan,

- Failing to cut losses,

- Impulsive trading,

- and overtrading.

Trading psychology examines how these instincts influence your decision making process and how you can stay in control the whole time.

So, how do you build the winning trader mindset?

It starts with managing emotions, sticking to your trading plan and understanding that psychology and trading go hand in hand. Trading discipline and risk management are key, but so is learning to handle the pressure of trading with real money. This is where a prop firm like Leveraged can be incredibly beneficial, especially for beginners. You’re practicing with the prop firm’s money, which significantly reduces the emotional stress of risking your own money.

Ready to dive deeper?

Let’s explore five essential trading psychology tips to help you navigate the mental challenges of forex trading.

But first…

What is Trading Discipline?

Trading psychology refers to the emotional and mental state that influences the decision-making process of traders in financial markets. It encompasses the various trading emotions, biases, and cognitive processes that can affect how traders perceive and react to price movements, risks, and trading opportunities.

Key elements of trading psychology include:

- Emotional control: Managing reactions to both winning and losing trades

- Discipline: Following trading plans and trading strategies consistently

- Risk management: Making rational decisions about position sizing and risk exposure

- Confidence and patience: Having conviction in your analysis while waiting for appropriate opportunities

- Stress Management: Trading can be stressful, and managing stress is essential for maintaining clear thinking and emotional stability. Techniques such as mindfulness, regular breaks, and maintaining a healthy work-life balance can help.

- Resilience: The ability to recover from losses and setbacks is crucial. Resilient traders learn from their mistakes and use them as opportunities for growth rather than becoming discouraged.

- Cognitive biases: Recognizing and overcoming mental shortcuts that lead to poor trading decisions. Common biases include:

- Confirmation Bias: Favoring information that confirms pre-existing beliefs while ignoring contradictory evidence.

- Overconfidence: Overestimating one’s ability to predict market movements.

- Loss Aversion: Preferring to avoid losses rather than acquiring equivalent gains, which can lead to holding losing positions too long.

Behavioral Finance Connection

An interesting aspect is the link between trading and psychology to behavioral finance, which studies how human behavior affects financial decisions. This connection shows that market trends can be influenced by collective emotions, like optimism driving bull markets or fear causing bear markets, adding a broader context to individual trading psychology.

Examples in Action:

- A trader on a winning streak might become overconfident, taking bigger risks and facing losses when the market shifts.

- Another trader might hold onto losing positions, hoping for a reversal, driven by fear of realizing a loss, which can lead to taking bigger losses.

- A trader feeling FOMO (fear of missing out) might jump into a trade without trade analysis, following others’ success, often leading to poor results.

How to Improve Trading Psychology for Beginners

Improving your trading psychology isn’t just about trading strategies – it’s about nurturing your mental health and building resilience. Trading psychology and mental health go hand in hand, as the stress of the markets can take a toll on even the most seasoned traders. This is where the 90% rule comes into play – while only 10% of trading success relies on strategy, a staggering 90% hinges on your psychology.

So, how can you strengthen your trading mindset and stay sharp?

One of the best ways to start is by diving into trading psychology books. Classics trading books like The New Trading for a Living by Dr. Alexander Elder and works by Mark Douglas on trading psychology offer invaluable insights into mastering your emotions and developing discipline. Mark Douglas’ trading psychology books “Trading in the Zone” and “The Disciplined Trader” explore how beliefs and thought patterns affect trading decisions. These resources break down the mental barriers that hold traders back, helping you trade mindfully and with purpose.

Trading psychology for beginners might feel overwhelming, but it’s all about taking small, consistent steps. Focus on trading psychology for mental well-being by setting realistic goals, managing stress, and maintaining a balanced lifestyle. Whether you’re reading, taking courses, or seeking advice from a trading psychologist, by prioritizing trading psychology for mental well-being, you’re not just improving your trading – you’re investing in a healthier, more balanced approach to the markets.

Ready to transform your forex trading mindset?

See below 5 trading psychology tips to build that support for your trading success.

Trading Psychology Tips for Beginners

Now that we’ve established how crucial trading psychology is, let’s dive into 5 trading psychology tips for beginners to help you build a winning mindset. Whether you’re exploring day trading psychology or focusing on long-term strategies, these tips will set you on the right path.

1. Create a Solid Trading Plan—and Stick to It

One of the most essential trading psychology tips for beginners is creating a trading plan, which is the cornerstone of disciplined trading. Your plan should outline specific entry and exit criteria, position sizing rules, and the markets you’ll trade. The plan acts as an objective framework for making decisions, reducing emotional interference. A comprehensive plan includes:

- Your trading goals and time horizon

- Markets and timeframes you’ll focus on

- Specific setups you’ll trade

- Risk management parameters for each trade

- Maximum daily/weekly losses

- Criteria for taking breaks from trading

When emotions run high, your trading plan becomes an anchor, preventing impulsive decisions that often lead to regrettable trades. Remember, a plan is only effective if you follow it consistently. This is another area where a prop firm environment excels. Leveraged, for example, has clearly defined rules regarding daily and maximum drawdowns (4% and 10% respectively for the Senior Portfolio Manager Challenge). These rules force you to practice good risk management and stick to a plan, even if you haven’t fully internalized those habits yet.

2. Develop a Healthy Relationship with Trading Losses

Trading losses are inevitable, even for professional traders. Managing emotions in forex trading starts with accepting losses as a normal part of the business rather than personal failures. Instead of letting trading losses shake your confidence, view them as learning opportunities, adjust your strategy if needed, and move forward. Many tips for beginner traders focus on techniques, but psychological resilience comes from separating your self-worth from the trading outcomes. Beginner traders should:

- Set predetermined stop-losses before entering trades

- View losses as tuition fees for market education

- Never increase position size to recover losses

- Take short breaks after significant drawdowns

- Analyze losses objectively without emotional attachment

Your response to losses defines your forex trading career more than your reaction to wins. Just like a losing trade doesn’t make you a failure, neither a winning trade makes you a genius.

3. Maintain a Detailed Trading Journal

A trading journal is invaluable for improving your psychological approach to markets. Beyond recording entries and exits, document your emotional state before, during, and after every trade. This practice creates awareness of how emotions influence your performance. For each trade, record:

- Market conditions and setup identification

- Your emotional state when entering

- Any deviations from your plan

- Outcome and lessons learned

Review your journal regularly to identify emotional patterns that harm your performance. This self-reflection accelerates growth and helps avoid repeating psychological mistakes. Leveraged’s AI-powered tools can supplement your journaling by providing unbiased feedback on your trades, helping you spot patterns you might miss.

4. Prioritize Risk Management

Risk management isn’t just about protecting your capital—it’s about protecting your mental well-being. By limiting your exposure to each trade, you reduce the emotional toll of potential losses. Tips for beginner traders often emphasize this: never risk more than you can afford to lose. The Leveraged Senior Portfolio Manager Challenge, with its unlimited time limit and reasonable profit targets (5% and 8%), encourages a measured approach to risk – like the maximum daily drawdown limits, which provide a framework that naturally enforces good risk management habits.

Trader Risk Tolerance Calculator

Answer the questions below to determine your trading risk profile and receive personalized risk management recommendations.

1. During a trading session, one of your positions quickly moves against you by 2%. What is your immediate reaction?

Your Trading Risk Profile

5. Trade Mindfully and Follow Routines

Day trading psychology, in particular, requires immense discipline. The fast-paced nature of the markets can trigger impulsive decisions, so it’s crucial to trade mindfully. Take breaks, avoid overtrading, and always stick to your plan. Over time, this discipline will become second nature. Consistent routines also help stabilize emotions. To trade mindfully, establish pre-market rituals that get you in the right mental state. This might include:

- Reviewing your trading plan

- Setting clear intentions for the day

- Brief meditation or breathing exercises

- Physical exercise to reduce stress

Become a Portfolio Manager with Leveraged

The journey to becoming a consistently profitable trader is as much about mastering your mindset as it is about developing a winning strategy. By implementing these trading psychology for beginners tips and embracing a disciplined approach, you can significantly improve your chances of success. As we've explored these psychological aspects of trading, you might be wondering:

"How can I practice these skills without putting my savings at risk?"

This is where proprietary trading firms offer a compelling solution.

See below…

The Prop Trading Advantage for Developing Traders

At Leveraged, our goal is to empower traders like you. We provide the capital, the tools, and the supportive environment to help you hone your skills and achieve your trading goals. Our Senior Portfolio Manager Challenge is designed to identify and nurture trading talent, giving you the opportunity to manage significant capital without risking your own. With features like up to 1:100 leverage, a transparent simulation process, and access to AI-powered insights, Leveraged offers a unique path to becoming a professional trader.

Ready to take the next step?

Start your Leveraged Senior Portfolio Manager Simulation today and begin your journey towards becoming a funded Portfolio Manager.

Test your skills, refine your trading strategy, and experience the benefits of trading with a supportive prop firm.

Click the button below to get started!