Jul 23, 2025 /Level: Beginners /Avg reading time: 8 minutes

Every new trader enters the world of forex trading with one dream: to make money with forex and achieve financial freedom. They begin their journey determined to learn how to make money from trading forex, picturing the potential of a $100,000 trading account and the professional life it could bring. But for many, that path feels impossible, a goal reserved for a select few. What if it wasn’t?

The hard truth is that most aspiring traders in the vast forex market never reach that goal. They search endlessly for how to trade forex successfully, but the real reasons for failure are often overlooked. It’s rarely about a lack of desire or intelligence. It boils down to two critical barriers that stand like walls between the average retail trader and professional success:

- Lack of capital

- Lack of discipline.

Trading a small, personal account puts immense psychological pressure on every decision, making disciplined risk management feel impossible. At the same time, even consistent profits on a small account barely generate enough income to be meaningful. This is the retail trader’s trap.

But there is a path forward.

This guide provides a two-part blueprint designed to break that cycle. We will give you a realistic guide to professional trading. First, we will cover the non-negotiable skills and forex trading strategies required to become consistently profitable. Second, we will reveal the exact path that modern traders are using to overcome the capital and discipline barriers – the path to getting a funded trading account.

This is more than just a tutorial; it’s a roadmap showing you how to make money from trading forex by evolving from a retail trader into a funded professional.

The Core of All Successful Trading: Forex Risk Management

If you ask a hundred aspiring traders how to make money from trading forex, you will get a hundred different answers, most focused on fancy indicators or secret trading strategies. But if you ask a hundred professional traders what separates them from the 95% who fail, you will hear one answer more than any other: risk management.

This is the single greatest secret in the foreign exchange market. Amateurs focus on how much they can win on a single trade; professionals focus on how much they are willing to lose. Before you can achieve consistent Forex trading profit per day (a misleading goal we’ll address), you must first master the art of survival. Effective risk management is not just a part of successful forex trading – it is the entire foundation upon which it is built.

This is the non-negotiable skill set that separates professional FX trading from gambling. Let’s break down the three pillars.

The 1% Rule: Protecting Your Trading Capital on Every Trade

The first question every new trader asks is, “how much money to start trading forex?” The professional answer is that the starting amount is less important than how you protect it. The 1% rule is your ultimate defense.

The rule is simple: you should never risk more than 1% of your total trading capital on a single trade.

If you have a $5,000 account, your maximum risk per trade is $50. If you have a $100,000 funded account, your maximum risk is $1,000. This rule is not about limiting your profits; it’s about ensuring your survival. A 10% loss requires an 11% gain to recover. A 50% loss requires a massive 100% gain just to get back to breakeven. The 1% rule prevents the catastrophic losses from which most trading accounts never recover. It keeps you in the game long enough for your trading strategies to work.

| Loss % | Required Gain to Break Even |

| 10% | 11.11% |

| 20% | 25% |

| 30% | 42.86% |

| 50% | 100% |

| 70% | 233.3% |

| 90% | 900% |

How to Set a Stop-Loss to Minimize Your Trading Losses

A stop-loss is a pre-determined order you place to exit a trade automatically if the price moves against you to a specific level. Trading forex without a stop-loss is like driving a race car without brakes.

Hope is not a trading strategy. A stop-loss removes emotion from the equation. You decide your maximum acceptable loss when your mind is clear and your technical analysis is complete – before you enter the trade.

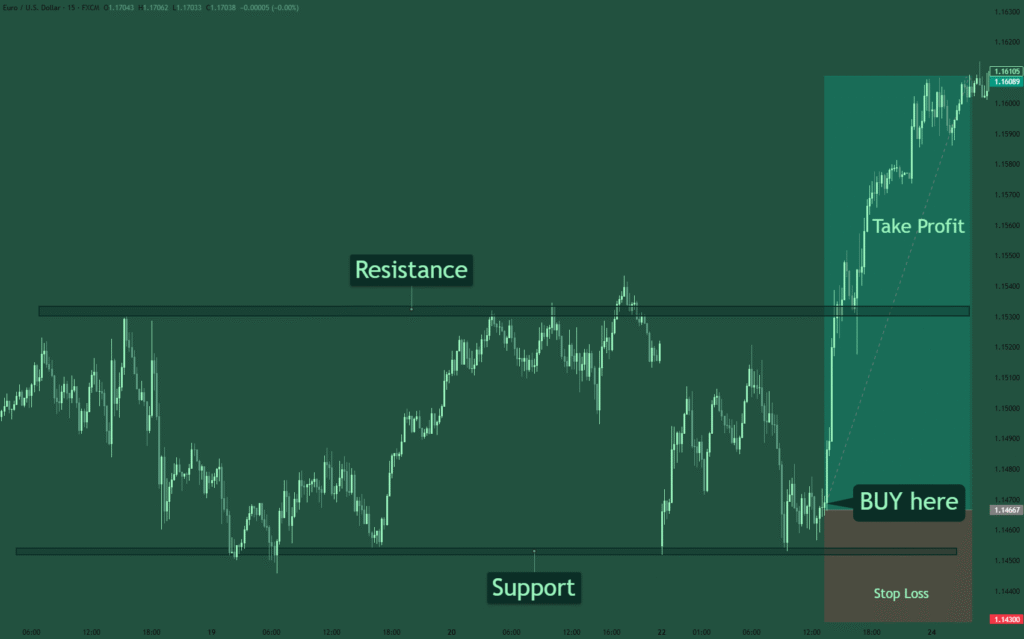

Here’s a practical example:

Let’s say your analysis of the EUR/USD currency pair suggests a potential buying opportunity at 1.0850. You identify a key support level at 1.1450. You would place your stop-loss just below that level, perhaps at 1.1430. This way, if your analysis is wrong, your loss is defined, small, and automatically managed, allowing you to move on to the next opportunity with your capital intact. It is the most critical tool to minimize your trading losses.

Calculating Risk-to-Reward to Ensure Long-Term Profitability

This is the concept that truly answers the question, “can you get rich trading forex?” The answer isn’t in one lucky trade; it’s in simple, professional math.

The risk-to-reward ratio (R:R) compares the amount of money you are risking on a trade (the distance from your entry to your stop-loss) to the amount of potential profit (the distance from your entry to your profit target).

Professionals only take trades where the potential reward is significantly larger than the risk. A common minimum is a 1:2 risk-to-reward ratio.

- Risking $100 to make $200 (1:2 R:R): With this ratio, you only need to be right more than 34% of the time to be profitable. You can be wrong almost twice as often as you are right and still grow your account.

- Risking $100 to make $300 (1:3 R:R): Here, your break-even win rate is just 25%.

Risk-to-Reward Probability Wheel

Discover how often you need to be right to stay profitable

This is the key to long-term profitability. You don’t get there by being right all the time. You get there by ensuring your winning trades are substantially larger than your losing trades. This mathematical edge, applied consistently over hundreds of trades, is how professionals build wealth in the markets.

So You’re Profitable… Why Isn’t Your Account Growing?

So, you’ve done everything right. You’ve put in the hours to learn to trade forex, you’ve mastered your forex trading strategies, and you’ve followed your risk management plan to the letter. You’re finally profitable – a huge achievement most never reach.

Yet, you look at your trading account balance at the end of the month, and the number is… underwhelming. You’re doing everything the experts tell you, but your dreams of financial freedom feel just as far away as when you started.

This is the most frustrating stage for a developing forex trader, but it’s also the most common. The problem isn’t your trading skill. The problem is you’re facing two invisible walls that are almost impossible to scale on your own.

The Undercapitalization Trap: Why a $1000 Account Limits Your Income

The first wall is a simple, brutal mathematical reality. Let’s say you have a fantastic month and achieve a very respectable 10% return on your $1,000 account. That’s a $100 profit.

While that 10% is proof of your skill, it won’t pay the rent. It won’t replace your job. It won’t change your life. This is the undercapitalization trap. The small forex trading income generated from a small account creates a dangerous temptation: to abandon your risk management, over-leverage your positions, and chase unrealistic trading profits to “speed up” the process. This is the number one reason why even skilled traders ultimately fail in their quest to figure out how to make money from forex trading long-term.

The Undercapitalization Trap

See how starting capital dramatically affects your path to meaningful income

The Psychology of “Scared Money”: How Trading Your Own Capital Leads to Errors

The second, more powerful wall isn’t on a price chart; it’s in your head. When your trading capital is your own hard-earned savings – money earmarked for bills, family, or your future – you are trading with “scared money.”

Every tick against your position creates a knot in your stomach. Every loss feels personal and devastating because it’s real money disappearing from your life. This intense trading psychology leads directly to predictable and catastrophic trading errors:

- Closing winning trades too early: You grab a small profit out of fear it will vanish, sabotaging your risk-to-reward ratio.

- Holding losing trades too long: You pray for a reversal because accepting the loss feels too painful, turning a small, manageable loss into a devastating one.

- Revenge trading: After a loss, you jump back into the market out of desperation to “make it back,” abandoning your trading strategy entirely.

This cycle of self-sabotage is the silent killer of trading careers. You might have the perfect trading strategy, but if you’re too afraid to execute it flawlessly, you’ll never understand how to earn money using forex consistently. The problem isn’t your skill; it’s the high-stakes environment you’re forced to trade in.

The Funded Trader Path: How to Trade Forex Without Risking Your Capital

You’ve seen the traps: the capital wall that makes meaningful income impossible and the psychological pressure of “scared money” that leads to critical errors. So, what’s the solution?

What if you could completely separate your trading skill from your personal bank account? What if you could prove your ability to trade and, in return, be given a large-scale account to manage?

This is the Funded Trader Path. It’s the modern answer to the question of how to make money from trading forex, and it’s built on a simple but revolutionary idea: you provide the talent, and a proprietary trading firm provides the capital. This is how to trade forex like a professional – without risking your own funds.

What is a Funded Forex Account and How Do They Work?

A funded forex account is a live trading portfolio provided to you by a proprietary trading firm. Instead of you depositing your own money, the firm allocates its own capital for you to trade.

Proprietary trading firms, or “prop firms” like Leveraged, exist to solve the exact problems we’ve discussed. We are not a brokerage; we are a firm that invests in trading talent. Our business model is to find and grow ambitious traders to become our portfolio managers in return for the lion’s share of their generated profits.

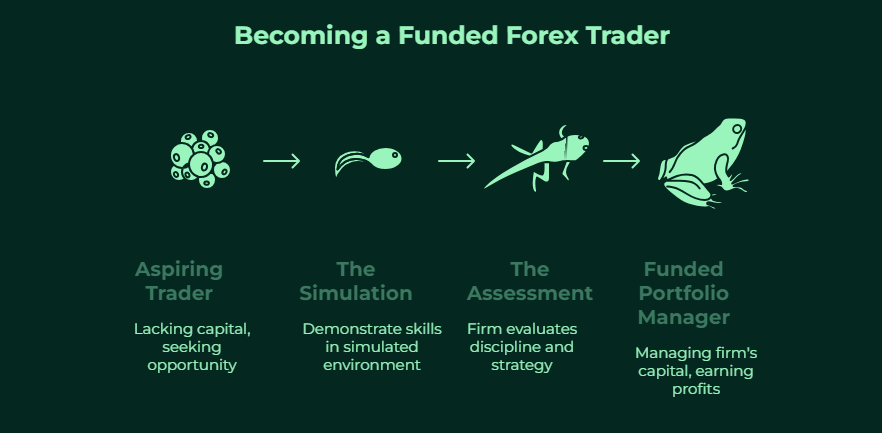

The process is designed to be a transparent and fair assessment of skill:

- The Simulation: You first demonstrate your ability in a simulated environment, adhering to clearly defined risk rules. This is your professional audition.

- The Assessment: We use this simulation to assess your discipline, your strategy, and your consistency—the true markers of a professional trader.

- The Funded Portfolio Manager: Upon successfully completing the simulation, you become a Leveraged Portfolio Manager, eligible to manage a portfolio of up to a million dollars.

This entire process is designed to answer the question, how to make money in forex, by focusing on skill, not just starting capital.

The Key Benefits: Accessing Large Capital and Keeping 80%+ of Profits

The prop firm benefits directly attack the two walls that hold retail traders back.

First, we solve the capital problem. Remember that 10% monthly gain on a $1,000 account? That’s just $100. But with a $100,000 funded account from Leveraged, that same 10% becomes a $10,000 profit. This is how your trading skill can translate into life-changing income.

Second, you are rewarded for your performance. As a Leveraged Portfolio Manager, you keep 80% of the profits you generate. This profit split ensures our interests are perfectly aligned. We succeed when you succeed. We provide the capital, the AI-powered tools, the free courses, and the daily webinars; you provide the skill.

How Prop Firm Rules Force the Discipline Needed for Success

The “scared money” psychology disappears when your life savings aren’t on the line. But how do you ensure trading discipline? This is where the beauty of the prop firm rules comes in.

Our rules, such as a maximum daily loss limit and a maximum overall loss, are not designed to restrict you. They are designed to be an unbreakable trading plan that forces professional trading discipline. They are the guardrails that prevent the emotional mistakes – like revenge trading or holding a loser too long – that destroy retail accounts.

This structured approach, which includes managing your leverage effectively within our program limits (e.g., up to 1:100), removes the guesswork and emotion. It trains you to think and act like a professional fund manager because, with us, that’s exactly what you are on your way to becoming.

The Bottom Line

So, let’s return to the original question. Can you get rich from forex trading?

The path to building a professional trading career is very real. The true answer to how to make money from trading forex consistently lies in understanding a fundamental truth: your trading skill is the engine, but capital is the vehicle. Without the vehicle, even the most powerful engine goes nowhere.

This is where the old model of retail trading fails and the funded trader path succeeds. By mastering your craft and then leveraging a firm’s capital instead of your own, you solve every one of the major problems that cause 95% of traders to fail. You eliminate the pressure of “scared money,” you gain access to a meaningful capital base, and you operate within a professional framework that protects you from your worst impulses. You stop being a retail trader fighting against the odds and start becoming a professional portfolio manager operating with an edge.

The question is no longer if you can build a career from forex, but how big you’re willing to trade. We provide the ‘how big’.

Your journey towards becoming a successful trader starts now. We provide the education, the AI-powered tools, and the capital you need to succeed. Click the button below now!