Feb 4, 2025 /Level: Beginners /Avg reading time: 5 minutes

Did you know most prop firm challenges aren’t lost to bad trades, but to overlooked trading strategy flaws? The good news: these mistakes are 100% fixable. Most traders often pour months into refining their trading strategy, only to hit roadblocks like profit target mismatches, inconsistent risk management, or misunderstood drawdown rules. Compliance with prop firm trading plans isn’t just about skill, it’s about aligning your trading approach with the rules that govern the prop firm ecosystem.

Solution: In this guide, you’ll learn a simple 5-minute trading strategy audit to spot and fix these hidden gaps, plus a free checklist to fast-track your path to prop funding. No more guesswork, whether you’re a scalper, swing trader, or algorithmic trader, this audit ensures your trading plan is built to pass – not fail – under pressure.

Why tweak your trading rules blindly when you can optimize them with precision?

Let’s begin.

Key Concepts: Understanding Prop Firm Trading Rules

At Leveraged, our trading rules are designed to protect both our capital while giving forex traders room to profit from the forex market. But, before you test your forex strategy, you need to grasp these non-negotiable requirements, and how they shape a prop firm trading plan that’s both profitable and compliant.

Profit Targets: Balance Ambition with Sustainability

At our Senior Portfolio Manager Simulation, Leveraged requires traders to hit a 5% profit target in Phase 1. While this might seem modest compared to aggressive targets like 15-20%, it reflects our focus on consistent growth over reckless gambles.

Why Leveraged’s 5% Rule Works: Strategies chasing inflated returns often self-destruct through overleveraging (Eg. 5%+ risk per trade). With our 1:100 leverage, discipline is non-negotiable, even small missteps compound quickly.

Pro Tip: Pair our 5% target with a 2:1 risk-reward ratio. This ensures sustainable progress while keeping equity drawdowns in check.

Ask yourself:

“Can my trading strategy hit 8% without gambling on volatile news events or overnight gaps?”

If not, refine it.

At Leveraged, we reward traders who replicate success across 100+ trades, not one-off “YOLO” wins.

Drawdown Limits: Your Safety Net, Not a Restriction

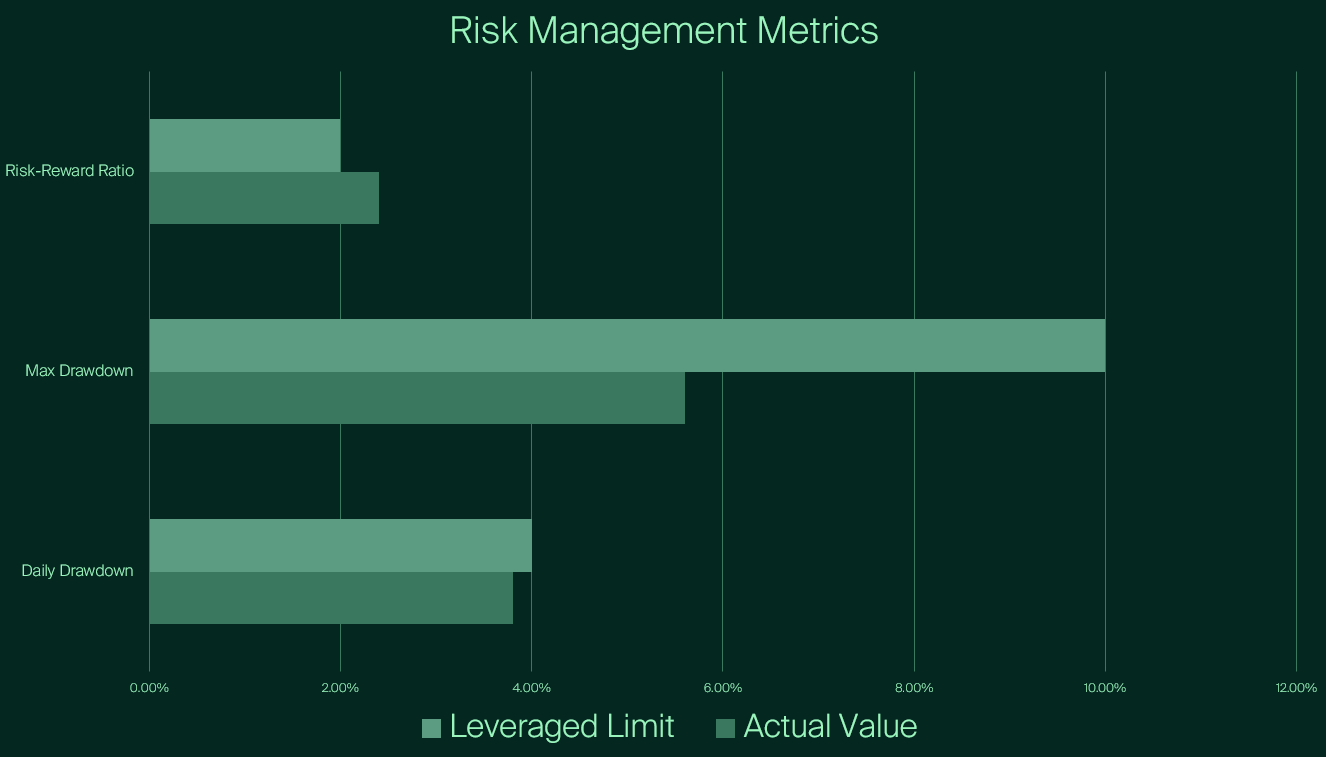

For Senior Portfolio Managers, Leveraged enforces a 4% daily drawdown and 10% max static drawdown—rules that separate professionals from gamblers. Your trading strategy must survive losing streaks without breaching these thresholds.

- Red Flag: High win rates mean nothing if a single losing streak breaches 10%. Backtest your Forex strategy against volatile scenarios (Eg: Fed announcements, geopolitical shocks) to ensure compliance. Avoid opening trades within a 5-minute window before high-impact economic news releases to avoid jeopardizing drawdown limits.

- Leveraged Advantage: Unlike firms with restrictive time limits, our “unlimited days” policy lets you recover strategically after losses, but only if you respect the prop firm drawdown rules.

Final Check: Does Your Trading Strategy Fit Leveraged’s Framework?

- Can it hit 5% without exceeding 4% daily risk?

- Does it withstand volatile markets while staying under 10% max drawdown?

- Will 1:100 leverage amplifies your edge, or your errors?

At Leveraged, we’re not just evaluating your trades, we’re testing your ability to thrive under the rules that define professional trading and maintain consistency. While most prop firms impose rigid minimum trading days, we require just 3 successful trading days – lower than industry standards – to validate consistency without unnecessary delays.

5-Minute Trading Strategy Tips to Improve Results

Learn how legendary traders like Paul Tudor Jones, Linda Raschke, and Steve Cohen refine their trading strategies – and how you can adapt their trading principles to pass prop firm evaluations.

Tip One: Trade Small to Survive

“Risk less than 1% of your speculative account on a trade.” – Ed Seykota

Risking more than 0.5 – 1% of your account balance per trade is a fast track to disqualification. If you manage up to $10k in prop funds, only risk between $50 and $100 per trade or between $500 and $1000 if you manage $100k in prop funds.

Tip Two: Master One Good Trade at a Time

“A jack of all trades is a master of none.” – Anonymous

Focus on mastering one trading setup, one strategy, one trading instrument, one trading session. Once you master your favorite currency pair, you’ll rule them all. A forex trading strategy that works in one market and repeatable condition, will work across many markets. Linda Raschke, a professional futures trader, only traded the same 3 candlestick patterns for 30 years.

Tip Three: Trading Journal – The Weekend Review Ritual

Self-auditing and weekly reviews expose patterns like overtrading after losses and helps you catch small trading mistakes before they trigger prop firm account termination. Here is what you need to do, every weekend analyzes your trades and ask yourself:

“Which trading setups worked and which trade signal failed?”

“Did I break my trading rules?”

Or,

“Where did emotions creep in, what triggered going on tilt?”

Tip Four: Perfect Your Trade Entries

A great entry point can turn mediocre trades into winners and turn unprofitable trading strategies into rule-compliant systems. Most traders jump in too early or chase the price due to FOMO (fear of missing out). Buying or selling at the “right price” reduces the stop loss, preserves capital, increases the RR ratio and keeps you within prop firm drawdown limits. How to fix it:

- Wait for confirmation: Enter only after price closes beyond a key level (Eg. a daily resistance zone or 200-period moving average).

- Avoid “noise” trading sessions: Steer clear of entries during low-liquidity sessions like the Asian forex market.

- Use rejection candles: Enter after a pin bar or engulfing pattern forms near support and resistance levels.

Common Mistakes to Avoid as a Portfolio Manager

Even the best trading strategy can fail prop firm evaluations if it ignores these common pitfalls. Steer clear of these errors to protect your FX account and secure funding faster.

Mistake One: Ignoring the Consistency Rule

The Problem: Traders often focus on hitting profit targets quickly, assuming speed equals trading skills, but at Leveraged, we prioritize sustainable wins not a single “hero trade.” We don’t restrict daily profit percentage, but we do require 3 successful trading days to pass your prop firm trading challenge.

Example: A trader aggressively forcing trades to hit the profit target goal in just 1 day, ignoring market conditions. While they technically “passed” the challenge, they failed to demonstrate trading consistency for long-term funded account management aka. minimum 3 successful trading days.

There is a simple solution to fix this: trade smaller position sizes to avoid overexposure on single days. The 3-day minimum is proof that you can replicate your trading success repeatedly which mirrors how senior portfolio managers mitigate impulsive risk taking.

Mistake Two: Overleveraging to “Catch Up”

The Problem: After a losing streak, traders often risk 5%+ per trade to recover losses, a guaranteed path to disqualification.

Example: Risking 5% on a EUR/USD trade to recoup $1,000 in losses.

Solution: Use a lot size calculator to enforce the 1–2% risk rule, no exceptions.

Loss and Gain Recovery Table

| Loss (%) | Gain to Recover (%) |

| 10 | 11.1 |

| 20 | 25 |

| 30 | 42.9 |

| 40 | 66.7 |

| 50 | 100 |

| 60 | 150 |

| 70 | 233.3 |

| 80 | 400 |

| 90 | 900 |

Mistake Three: Ignoring Real-Time Trading Strategy Feedback

The Problem: Many traders skip validating their trading strategy against live market conditions and prop firm rules, assuming “what worked before will work now.” Markets evolve, and prop firm trading strategies that thrived in a demo account might fail during live trading conditions – or worse, break critical funding rules.

The Fix: Start with a small live trading account, learn fast, and scale.

Example: Use Leveraged’s $10k Senior Portfolio Manager Challenge to:

- Test your prop firm strategy against live prop firm rules (drawdown, consistency, profit targets).

- Get free advanced AI analysis tools and gain an “unfair advantage” in the market without risking months or thousands of dollars.

- Refine your trading approach while earning profit splits.

Why It Works: You’ll learn faster in a live trading evaluation than in endless backtests.

Mistake Four: Letting Emotions Override Rules

The Problem: Abandoning your prop firm trading plan during FOMO or fear leads to blown accounts.

Example: Chasing a 10% daily profit target after a loss, only to breach drawdown limits.

Solution: Be consistent, enforce discipline.

Case Study: Successful Traders Story

Here’s how one trader transformed Leveraged’s framework into almost $10k profit without breaking a single prop firm rule. Meet Alex, a swing trader who passed the Simulation of his prop challenge in under 14 days. By sticking to Leveraged’s risk management rules, Alex netted $10,273 profit on a $100k account, despite suffering a small drawdown. His equity curve dipped 3.8% on Day 1 after taking 3 consecutive trading losses. But instead of revenge trading, he halved his lot size, adhering to the 4% daily drawdown limit.

By Day 7, Alex’s patience paid off as he managed to add more than 6% gains to his account balance, mostly trading gold (XAU/USD), EUR/USD and Bitcoin. By Day 14, he closed Phase 1 with a 5.3% gain avoiding volatile news windows like the 5-minute pre-NFP trap. Key trading stats:

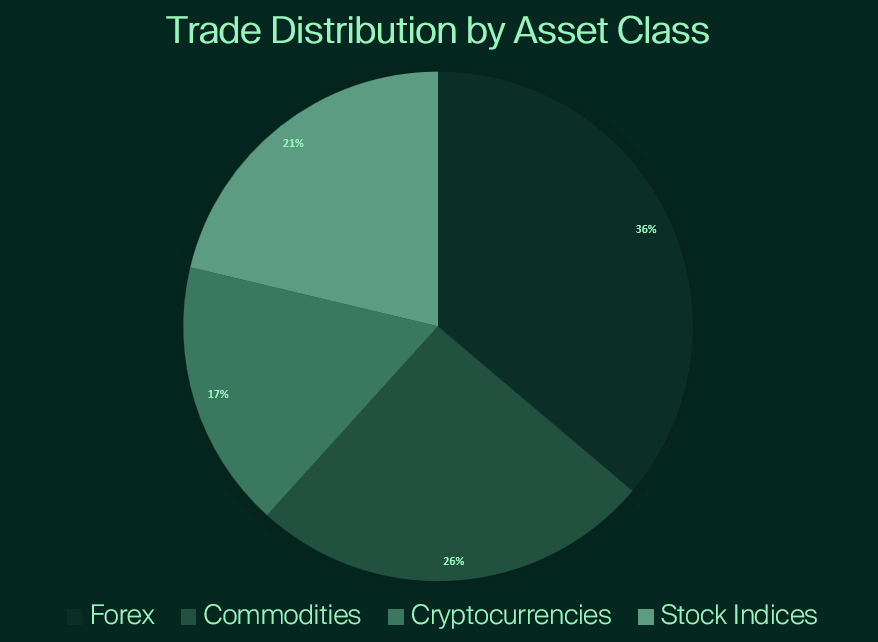

- Trades: 47 total (17 forex, 12 commodities, 8 cryptocurrencies and 10 stock indices)

- Avg Risk-Reward: 2.4:1

- Drawdown: 3.8% daily peak, 5.6% maximum DD static (under 10% cap)

- Most profitable hours: London and New York trading session overlap (2-5 PM GMT), where liquidity met his breakout trading strategy.

Final Takeaway: Alex’s success wasn’t luck, it was Leveraged’s rules in action: no trades 5 minutes pre-news, same-day closes, and SL/TP orders on every position. He traded small, while he occasionally re-entered GBP/USD too quickly post-loss, his 1% risk ceiling saved him from reaching the daily drawdown threshold.

Conclusion

Crafting a profitable trading strategy is only half the battle – consistency and adhering to the prop firm rules is what opens the door to funding opportunities. By auditing your trading plan for profit targets, drawdown limits, and the consistency, you’ll avoid the pitfalls that sink 70% of traders during evaluations.

Remember:

- Compliance beats greed: A 2% daily gain beats a 10% “hero trade” that can violate prop firm rules.

- Automate discipline: Checklists, alerts, and calculators remove emotion from the equation.

- Use the AI Analysis tools offered by Leveraged to gain an unfair advantage.

Don’t leave your prop firm funding to chance Download Your Free eBook to refine your trading strategy, then purchase a Simulation from Leveraged and begin your journey to become a Leveraged Portfolio Manager.

FAQ

What is a good trading strategy for a prop firm?

A top trading strategy for prop traders is disciplined swing trading, where positions are held for days to capitalize on trends while adhering to strict risk limits and avoiding overtrading.

Is it good to trade with prop firms?

Wondering what makes a prop firm so appealing? How about scaling your trading strategies without risking your own savings? Trading with prop firms can offer benefits like access to more capital, reduced personal financial risk, and performance-driven compensation. Traders can gain access to exclusive trading tools, expert mentorship, and valuable insights into the markets. Sounds like a win, right?

How do you trade for prop firms?

A trader typically starts by applying to take a firm-sponsored evaluation or challenge process. They need to prove their trading skills by meeting profit targets without exceeding a strict drawdown limit. If you pass the Simulation, then you can access firm capital to trade and earn a share of the trading profits.