Apr 29, 2025 /Level: Intermediate /Avg reading time: 13 minutes

Can AI trading truly deliver consistent profits, or is it another high-tech tool that promises more than it delivers? This guide aims to demystify AI day trading for beginners. We’ll explore how artificial intelligence trading works, weigh its potential benefits against significant risks, discuss its suitability for newcomers, and outline cautious steps for getting started with automated trading.

The promise of artificial intelligence trading taps into a core desire to overcome human limitations – primarily emotional decision-making and the sheer inability to process big data at the speed markets move. The potential seems immense. Yet, the reality of trading, especially day trading which involves entering and exiting positions within the same day, is fraught with risk.

At Leveraged, a new prop trading firm built for the modern trader, we aim to bridge this gap. We believe that talent and ambition, not just the size of your personal bank account, should determine your trading potential. Leveraged empowers individuals by providing a clear pathway to substantial trading capital (up to $1 million) without risking personal funds once qualified. How? By demonstrating your trading skills and discipline – potentially enhanced by AI strategies or our unique suite of AI-powered support tools designed to give our traders an edge – in our Leveraged Simulation.

As financial technology (fintech) continues its rapid evolution, platforms offering automated trading solutions become more accessible, promising to unlock the secrets of the market through complex algorithms and machine learning. But as we look towards 2025, a crucial question looms large for aspiring and experienced traders alike: Can this automation truly deliver the holy grail of consistent profits in the volatile world of day trading?

Let’s find out…

What exactly is AI Day Trading?

First, let’s clarify the basics. Day trading involves buying and selling assets like stocks (shares), options trading, currencies (foreign exchange), or even cryptocurrencies within a single trading day, aiming to profit from small price fluctuations. It’s inherently risky and requires significant skill, discipline, and time.

Now, add AI. At its heart, AI day trading involves using artificial intelligence – particularly machine learning techniques to:

- Analyze vast amounts of trading data and make autonomous trading decisions for intra-day strategies.

- Identify potential patterns and trends invisible to the human eye.

- Make predictive forecasts about short-term price movements.

- Execute trades automatically based on pre-defined or learned criteria.

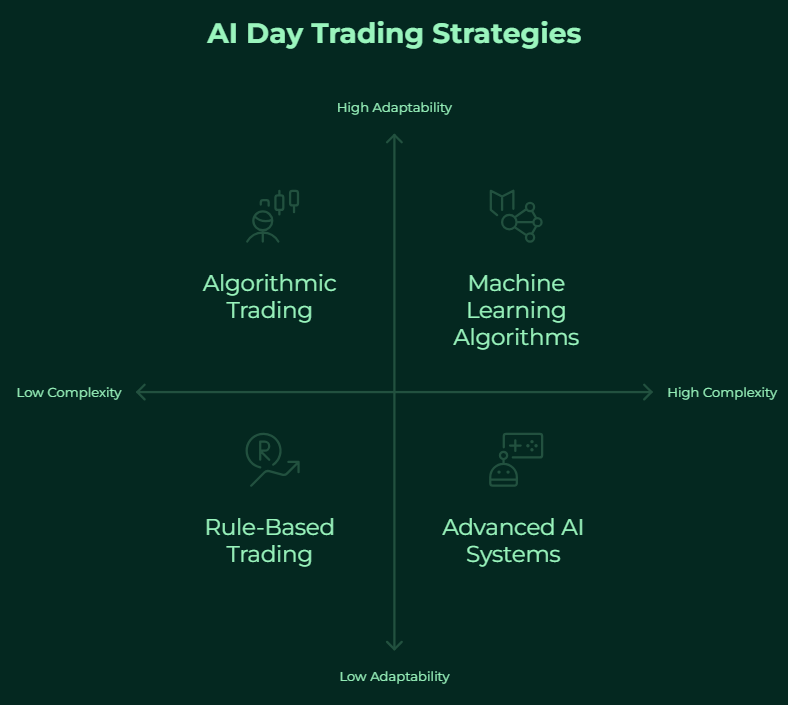

This goes beyond simple algorithmic trading or rule-based trading, where a system executes trades based on pre-programmed, fixed rules (e.g., “buy if Indicator A crosses Indicator B”).

Machine learning trading introduces the concept of systems that can learn from historical data and potentially adapt their strategies over time without explicit reprogramming for every new scenario. These systems analyze market data (prices, volume), unstructured data (news headlines, social media feeds via natural language processing or NLP), and various other inputs to identify patterns, predict trends, generate trading signals, and execute orders through brokers and prop trading firms via trading platforms.

Key components often include:

- Machine Learning Algorithms: The core engine analyzing data and making forecasts.

- Data Feeds: High-quality, real-time market data is crucial fuel.

- Trading Bots: Software applications that implement the AI’s decisions, executing trades automatically.

- Risk Management Protocols: Ideally, automated rules to limit losses (though effectiveness varies).

The ultimate goal of this automation is often to achieve results that are difficult or impossible for human traders, leveraging speed, data analysis capabilities, and emotionless trading.

While basic automated trading typically follows rigid “if-this-then-that” rules (rule-based trading), true AI trading systems can learn from historical data and potentially adapt their trading strategies over time, making them a more dynamic form of quantitative trading.

How AI Differs From Traditional Day Trading

Traditional day trading relies heavily on human judgment, technical analysis skills, and emotional discipline. In contrast, AI day trading introduces several key differences:

| Traditional Day Trading | AI Day Trading |

| Limited data processing | Can analyze billions of data points simultaneously |

| Susceptible to emotional decisions | Eliminates psychological biases |

| Time-intensive monitoring | Continuous 24/7 market surveillance |

| Manual execution | Automated entry and exit points |

| Limited backtesting capacity | Extensive historical data testing |

For newcomers to trading, this automation can be particularly appealing, as it removes many of the psychological barriers that typically challenge beginner traders, such as fear, greed, and uncertainty.

The Potential Benefits: Why Traders Explore AI

Traders are increasingly turning to AI day trading, drawn by several potential advantages over manual methods:

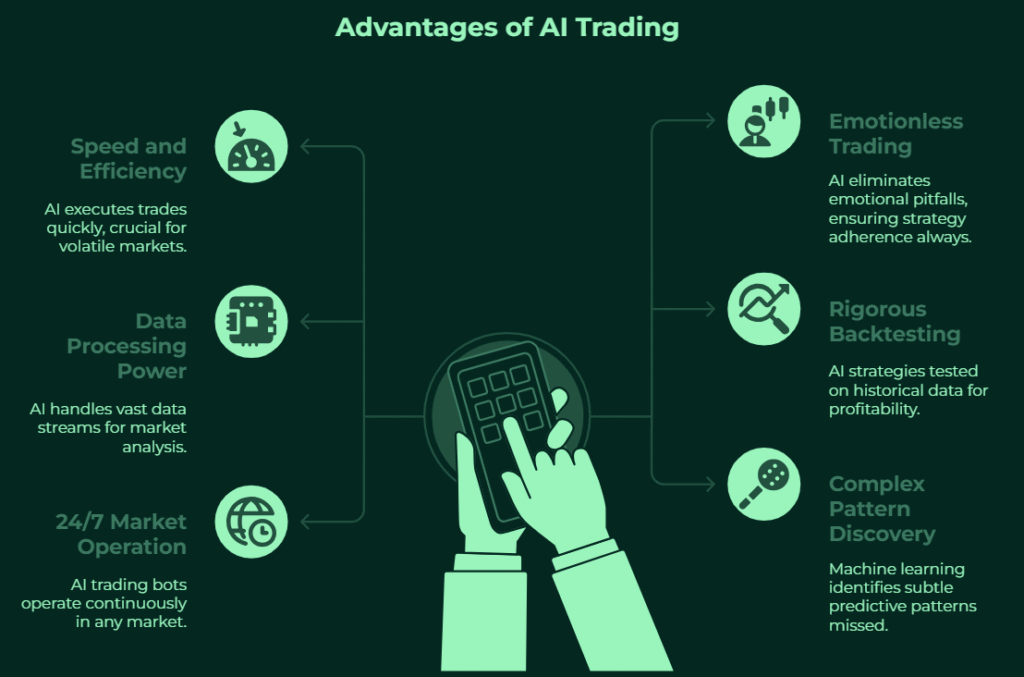

- Speed and Efficiency: AI executes trades and analyzes market data in milliseconds, crucial for volatile markets and automated trading.

- Emotionless Trading: Eliminates trading psychology pitfalls (fear, greed), ensuring adherence to programmed day trading strategies.

- Data Processing Power: Artificial intelligence handles vast big data streams (news, prices, indicators) for comprehensive market analysis.

- Rigorous Backtesting: AI trading strategies can be tested extensively on historical data to estimate potential profitability and refine approaches.

- 24/7 Market Operation: AI trading bots can operate continuously in markets like cryptocurrency trading or foreign exchange.

- Complex Pattern Discovery: Machine learning may identify subtle predictive patterns missed by standard technical analysis.

Risks and Challenges of AI Day Trading

Despite the potential, AI day trading is fraught with significant risks and challenges, especially for beginners. The market itself poses threats through market volatility and unpredictability, and AI models trained purely on historical data can fail dramatically during unforeseen “black swan” events or significant shifts in underlying market conditions.

AI Trading Risk Visualization

Potential profit/loss scenarios based on strategy profile

Max Profit

+0.0%

Max Drawdown

0.0%

Win Rate

0.0%

Final Return

+0.0%

Note: Simulated data for illustration purposes only

Comparison of Different AI Approaches

Various AI approaches have shown different results across market conditions:

| AI Approach | Bull Market Performance | Bear Market Performance | Sideways Market Performance |

| Trend-following | Excellent | Poor | Poor |

| Mean-reversion | Poor | Good | Excellent |

| Breakout systems | Moderate | Good | Poor |

| Sentiment analysis | Variable | Variable | Variable |

| Multi-factor | Good | Moderate | Moderate |

Technical pitfalls are also significant:

- Overfitting where an algorithm performs exceptionally well on past trading data during backtesting but fails during live trading.

- Technical Failures are always possible – bugs in AI trading programs, trading platforms outages, or poor data costs and quality can undermine even sophisticated AI trading strategies.

Furthermore, the risk of AI trading scams is also heightened, preying on hopes of easy profitability with unrealistic promises. Crucially, traders must accept there’s no “Holy Grail”; markets change, requiring continuous monitoring, optimization, and robust risk management. This constant need for adaptation underscores the importance of skill and robust strategy development. Furthermore, deploying any AI trading strategy, AI-driven or not, involves significant capital risk. For many aspiring traders, risking substantial personal funds is a major barrier. This is where alternative paths, such as demonstrating skill to trade a firm’s capital through prop firms, become attractive.

So, Can AI Day Trading Actually Drive Consistent Profits?

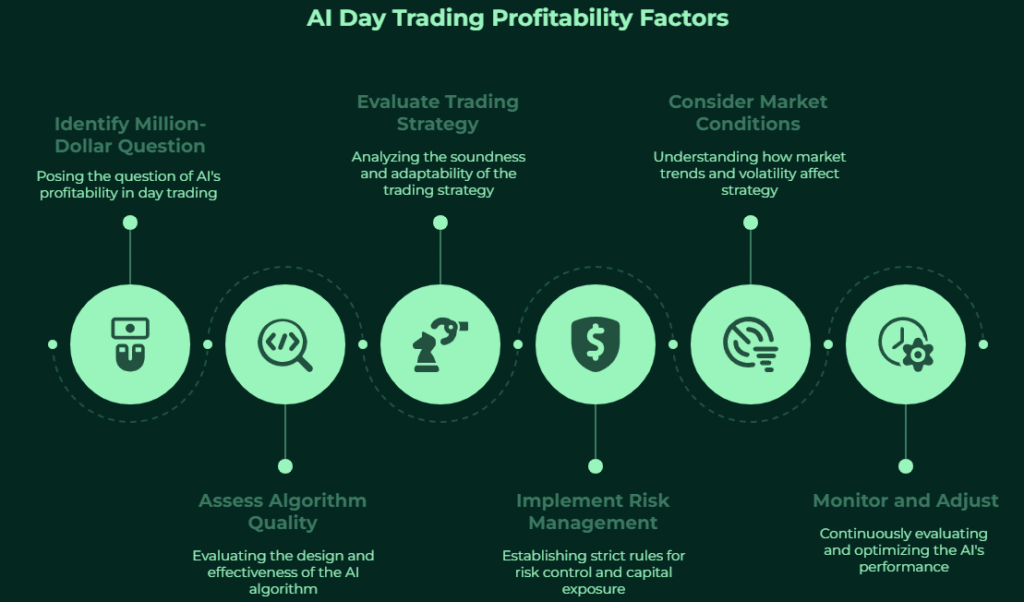

This is the million-dollar question: “Can AI day trading automation drive consistent profits in 2025?” The honest answer is: It’s possible, but extremely difficult, not guaranteed, and certainly not easy.

Consistent profits from AI day trading depend less on the “AI” label and more on the confluence of several critical factors:

- Quality of the AI/Algorithm: A poorly designed algorithm will lead to poor results, no matter how fast it trades.

- Robustness of the Trading Strategy: The underlying logic (day trading strategies, swing trading logic adapted for shorter frames, scalping strategies) must be sound, adaptable, and possess a genuine edge.

- Effective Risk Management: This is arguably the most critical factor. Even a potentially profitable strategy can wipe out an account without strict rules on position sizing, stop-losses, and overall capital exposure per trade. AI can execute risk rules, but humans must define them wisely. This discipline in risk management is precisely what prop firms like Leveraged look for and evaluate in their trading simulation.

- Market Conditions: Some strategies thrive in trending markets, others in volatile ranges. An AI strategy might perform well for months, then fail when the market conditions change.

- Continuous Monitoring & Adjustment: AI day trading is not “set and forget.” Performance needs constant evaluation of trading decisions, and strategies often require tweaking or complete overhauls as markets evolve. Optimization is an ongoing process.

Therefore, view AI trading as a powerful tool for automation, data analysis, and disciplined execution of investment strategies. It doesn’t eliminate the need for a solid trading plan and rigorous risk management. The AI itself doesn’t guarantee profitability; the intelligence behind the strategy and its management does.

Is AI Day Trading Suitable for Beginners?

Traditionally, AI day trading presented a steep learning curve, often perceived as inaccessible for beginners due to the required blend of deep market knowledge and significant technology skills, particularly in programming and data science. However, the landscape is rapidly changing, making automated trading powered by artificial intelligence potentially more suitable for newcomers than ever before.

The key catalyst for this shift is the rise of powerful, user-friendly AI tools. Consider the impact of advanced conversational AI models like ChatGPT, Claude, Google’s Gemini, Manus, and specialized AI-powered coding platforms. These tools are democratizing access to complex capabilities. For aspiring beginner traders interested in AI trading, this means:

- Prompt-Based Strategy Generation: Instead of needing to code complex algorithms from scratch, a beginner can now often describe a potential day trading strategy using natural language prompts. The AI can help translate these ideas into structured logic or even generate code snippets suitable for use in trading bots or AI trading programs.

- Lowering the Technical Barrier: While understanding the concepts is still vital, the need for intricate coding proficiency to initiate an automated trading setup is reduced. These AI assistants can handle much of the syntax and structure, bridging a significant part of the knowledge gap related to programming.

- Idea Exploration and Refinement: Beginners can use these AI tools to brainstorm strategy variations, ask clarifying questions about technical analysis indicators, or explore different risk management rule sets, accelerating the learning and development process within the fintech space.

AI Trading Strategy Selector Quiz

Find the perfect AI trading approach for your style and goals

1. What’s your primary trading goal?

2. How much time can you dedicate to monitoring your trading?

3. What’s your level of technical knowledge?

4. Which market condition do you prefer trading in?

5. How would you describe your preferred trading frequency?

6. What’s your stance on risk management?

7. Which assets are you most interested in trading?

Your Trading Strategy Results

Based on your preferences, here are the AI trading approaches that might work best for you:

Ready to test your AI trading strategy? Instead of risking your own capital, prove your skills with Leveraged’s Trading Simulation and manage up to $1 million of our capital.

Get LeveragedThis evolution means that algorithmic trading for beginners is becoming less about being a coding expert and more about having clear trading ideas and leveraging AI to help implement them. Platforms are emerging that integrate these AI capabilities, allowing users to build, test, and deploy AI trading strategies with greater ease.

However, accessibility to tools doesn’t automatically translate to trading success. Two major hurdles often remain: acquiring sufficient trading capital and developing the necessary skills and discipline. Today, prop firms like Leveraged democratize access through, AI-powered tools, simulated environment, and educational resources. Leveraged’s Junior Portfolio Manager Program ($1,000 account) lets beginners start small, using AI insights to refine strategies in a controlled setting. So, while AI tools lower the technical barrier for strategy development, prop firms like Leverage address the critical capital and skill-development barriers, creating a more viable path for dedicated beginners.

Case Study: Using ChatGPT to Develop an AI Day Trading Bot

It’s crucial to understand: ChatGPT cannot trade for you. It doesn’t have real-time market access, execution capabilities, or the ability to perform rigorous quantitative backtesting. However, it can be a powerful tool for brainstorming, defining logic, and even generating code snippets for a trading strategy.

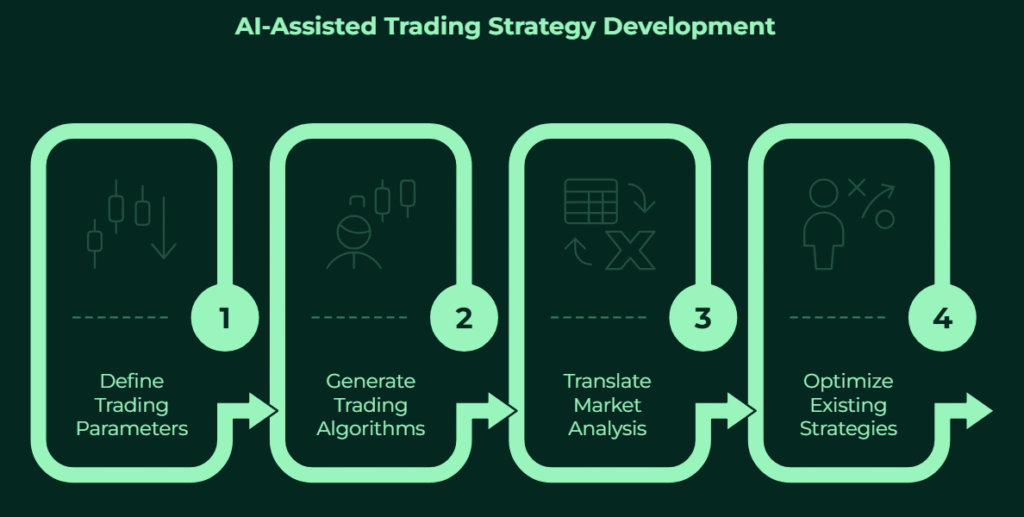

Here’s how beginners can leverage ChatGPT in trading:

- Define your trading parameters: Ask ChatGPT to help formulate clear rules for market entry, exit, position sizing, and risk management

- Generate trading algorithms: Request code snippets that implement specific trading strategies based on technical indicators

- Translate market analysis: Use ChatGPT to convert technical analysis concepts into algorithmic rules

- Optimize existing strategies: Feed ChatGPT your current trading rules and ask for optimization suggestions

For example, a beginner trader might prompt ChatGPT with: “Create a mean reversion day trading strategy using Bollinger Bands for forex trading with risk management rules.” The AI can then generate a complete strategy framework that the trader can implement or further customize. Remember, translating these AI-generated ideas into a consistently profitable, well-managed trading approach requires testing, discipline, and access to a trading environment – challenges that a structured path like a prop firm simulation offered by Leveraged can help address.

Final Words

AI day trading represents a fascinating convergence of financial markets and cutting-edge technology. While automation can indeed drive more consistent execution and remove emotional barriers, the path to consistent profits remains challenging. Tools like ChatGPT can serve as valuable assistants in the ChatGPT trading strategy conceptualization phase. For beginners, the most prudent approach is to start small, focus on learning rather than immediate profits, and gradually increase complexity as you gain experience. Remember that even the most sophisticated AI trading program is ultimately a tool – its effectiveness depends on the knowledge and discipline of the person using it.

Intrigued by the potential of AI in trading? Developed a strategy idea you’re eager to test in a real-world simulated environment? The concepts discussed in this article – strategy development, disciplined execution, rigorous risk management, and leveraging powerful tools – are exactly what proprietary trading is all about.

Leveraged offers you the platform to prove your abilities. Take on our Trading Simulation, showcase your skills in a simulated environment (supported by our unique AI-powered insights and comprehensive educational resources!), and you could soon be managing up to $1 million of our capital.

Stop just reading about trading success – start building it. Demonstrate your discipline and strategy, pass the evaluation, and unlock your potential as a funded Portfolio Manager with Leveraged. Click the Button below!

AI Day Trading FAQ

What is the best AI trading bot for beginners?

A: There isn’t one single “best” bot universally. Beginners should prioritize platforms emphasizing transparency, user-friendliness (relatively speaking), strong backtesting capabilities, clear fee disclosures, reliable customer support, and compatibility with reputable brokers. Focus on understanding how a specific bot or platform operates rather than solely chasing advertised returns. Always start testing with paper trading.

How much money do I need to start AI day trading?

A: This varies significantly based on platform/bot costs, potential trading data fees, and your broker’s minimum deposit rules. The most critical rule is to only ever invest capital you are fully prepared to lose. When transitioning from simulation to live trading, begin with a very small allocation.

Is AI day trading legal?

A: Yes, using algorithmic trading and AI for trading is legal in most major financial markets. However, it’s essential to ensure that any trading platforms, AI trading programs, or brokers you engage with are properly regulated and adhere to the financial laws of your jurisdiction.

Can AI predict the stock market with 100% accuracy?

A: No, absolutely not. AI employs data analysis and predictive analytics based on historical data and identified patterns to forecast probabilities, not certainties. Financial markets are complex systems influenced by countless factors, including unpredictable human behavior and global events. Claims of perfect prediction capabilities are a hallmark of scams.

Do I need coding or programming skills for AI day trading?

A: Not necessarily, especially if you plan to utilize pre-built AI trading bots or platforms featuring visual strategy builders. However, possessing a solid understanding of algorithmic trading concepts provides a distinct advantage. If your goal is to develop custom AI trading strategies from the ground up, then significant programming and data science skills become essential prerequisites.