May 14, 2025 /Level: Beginner /Avg reading time: 15 minutes

If you’ve heard traders talk about making dozens, even hundreds, of trades a day to capture tiny price movements, you’ve encountered the scalping strategy. It’s a high-frequency trading approach, a form of quick-paced trading that contrasts sharply with long-term investing. For novice traders, scalping can seem daunting. But behind the speed lies a trading strategy focused on capturing frequent profitable price movements, aiming for consistent wins that, while small individually, can add up significantly over time.

However, making these small wins truly impactful often requires significant trading capital, a barrier for many starting out. This is where opportunities like proprietary (prop) trading firms, like Leveraged, which provide capital to skilled traders, become particularly relevant.

This article is designed specifically for scalping for beginners. The aim is to demystify the scalping strategy, explaining exactly what it involves and how skilled day traders aim to profit from rapid trades. Additionally, we will explore the core mechanics, the essential scalping tools you’ll need, common types of scalping strategies, and crucially, the mindset and risk management required. Ultimately, our goal is to provide a clear explanation, helping you understand if this demanding yet potentially rewarding approach aligns with your trading personality, goals and how you might pursue it even without large personal capital through avenues like prop firm simulations.

Is profitable scalping achievable? Can you really make money from these rapid trades? Let’s find out.

What is Scalping in Trading?

At its heart, a scalping strategy is an extremely short-term trading style that aims to profit from very small price movements. Unlike swing traders holding positions for days or weeks, or even typical day traders who might hold for several hours, scalpers operate on much shorter timelines. We’re talking about short holding periods – trades that might last only a few minutes, or sometimes just seconds.

| Scalping Component | Typical Range (Guideline) | Real-World Application Insights |

| Time Frame | 1-minute to 15-minute charts | Most scalpers gravitate towards 1-minute and 5-minute charts for entry/exit signals, sometimes using slightly higher frames (like 15-min) for broader trend context. |

| Profit Target | 5-20 pips (Forex) / 0.05− 0.20 (Stocks) | Often aims for a small, achievable profit per trade, frequently around 5-10 pips or 5-15 cents. |

| Trade Frequency | 10 to 100+ trades per day | Highly variable. Some scalpers execute dozens, even over a hundred transactions daily, while others might take 10-30 highly selective trades during peak volatility periods. |

| Stop Loss | 5-15 pips (Forex) / 0.05−0.15 (Stocks) | Often set just below recent swing lows (for longs) or above swing highs (for shorts), typically within a 5-10 pip/cent range to ensure a favorable risk/reward ratio, even if it’s just 1:1 or slightly better. |

How Scalping Works

The core idea isn’t to catch large market swings. Instead, scalpers focus on exploiting tiny inefficiencies and small price movements that occur constantly throughout the trading day. Each successful trade might only net a few pips (in Forex) or cents (in stocks), but the sheer volume – the high trade frequency – is where the potential profit lies. Think of it this way: while a swing trader might aim for a 100-pip profit over several days, a scalper might aim for a 5-pip profit but execute 20 such trades in a single trading day.

This approach relies heavily on technical analysis rather than fundamental factors like company earnings or broad economic news (though scalpers must be aware of major economic announcements or earnings reports that can cause sudden volatility). Specifically, they analyze price action, chart patterns, and technical indicators on very short timeframes like tick charts or one-minute charts to identify trading opportunities.

Because the profit margin per trade is razor-thin, scalping demands precision, speed, and unwavering discipline. Consequently, there’s little room for error; a moment’s hesitation or letting a losing trade run can quickly wipe out the profits from several successful trades. In essence, it’s about consistency and maintaining a high win-loss ratio where possible, or ensuring winning trades slightly outweigh losing ones after costs. This level of discipline is exactly what prop firms like Leveraged look for when evaluating traders to manage their capital.

Transaction Cost Visualizer

Profitability Breakdown:

Total Gross Profit: $0.00

Total Commission Paid: $0.00

Total Spread Costs: $0.00

Total Transaction Costs: $0.00

Net Profit: $0.00

What does a scalper do?

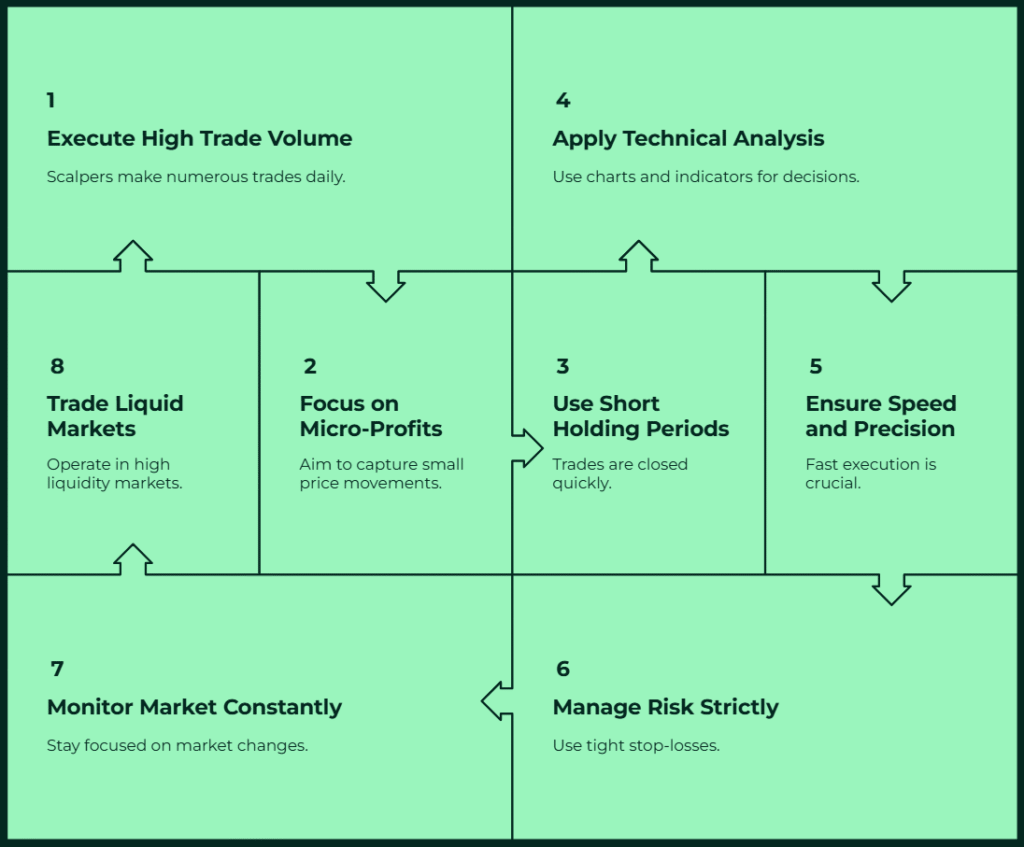

A scalper's day is characterized by intense focus and rapid activity. Here’s what defines their actions:

- High Trade Volume: They execute numerous trades daily, sometimes dozens or even hundreds.

- Focus on Micro-Profits: The goal is consistently capturing very small price movements.

- Short Holding Periods: Trades are opened and closed rapidly, often within seconds or minutes.

- Heavy Reliance on Technical Analysis: Scalpers use chart patterns, price action, and technical indicators on short timeframes to make quick decisions. Fundamental analysis is generally ignored for entry/exit timing.

- Speed and Precision: Fast trade execution is critical. Hesitation can turn a potential small win into a losing trade.

- Strict Risk Management: Using tight stop-losses on every trade is non-negotiable to protect capital from adverse moves.

- Constant Market Monitoring: Requires intense focus during active trading hours to spot fleeting opportunities and manage open positions.

- Operating in Liquid Markets: They primarily trade liquid securities or instruments with high market liquidity and tight spreads to ensure efficient entry and exit.

How Scalping Works Core Principles

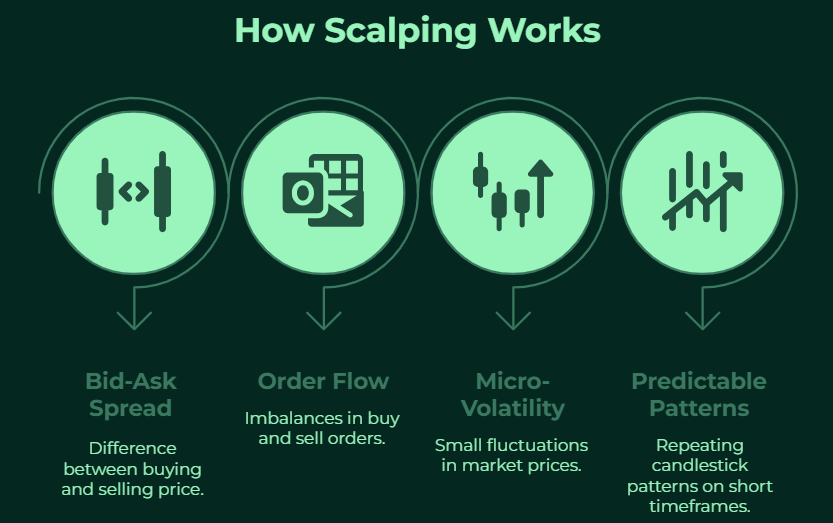

So, how do scalpers actually find these tiny profit opportunities? Essentially, it boils down to exploiting micro-level market dynamics:

- The Bid-Ask Spread: This is the small difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). Scalpers might try to capture this spread (Market Making style) or trade in a way that anticipates small movements beyond the spread. Crucially, tight spreads are absolutely essential, as wide spreads can instantly make a small intended profit impossible.

- Order Flow Imbalances: By watching Level II market data (the order book), scalpers can sometimes see where large buy or sell orders are stacking up. Trading in anticipation of these orders being filled, or reacting as they are absorbed, can create small, quick profit chances (Market Depth Scalping).

- Micro-Volatility & Momentum: Even in seemingly calm markets, prices constantly fluctuate. For this reason, scalpers use technical indicators and watch price action closely to identify tiny bursts of market momentum – a quick push up or down – and subsequently try to ride that wave for a few seconds or minutes. This involves identifying potential breakout points from micro-consolidation patterns.

- Predictable Patterns: Certain candlestick patterns might repeat on very short timeframes. For instance, scalpers look for these short-term market patterns, perhaps bounces off short-term moving averages or brief reactions to hitting certain indicator levels, aiming to capitalize before the market moves on.

Why Leverage is Important?

To make these tiny moves meaningful, leverage is often employed. Leverage allows traders to control a larger position size with a smaller amount of capital. While this amplifies potential profits from small moves, it equally amplifies potential losses. Such a reliance on leverage highlights a challenge for many beginners: accessing sufficient capital to trade meaningful sizes without risking vast personal sums. In this situation, proprietary trading firms, like Leveraged, step in. Prop firms provide traders with access to significant capital and leverage (often up to 1:100, as offered in Leveraged's Senior Portfolio Manager challenges), allowing skilled traders to focus on strategy execution rather than capital limitations.

Success heavily depends on market liquidity. High liquidity means there are always plenty of buyers and sellers, allowing traders to enter and exit positions quickly at predictable prices with minimal slippage (the difference between the expected execution price and the actual execution price).

Best Scalping Strategies for Beginners

While there's no single "best" scalping strategy, several common approaches leverage different market dynamics and technical indicators. Therefore, novice traders should understand these scalping trading strategies before deciding which to practice and potentially master. Remember, simplicity and clear rules are key when starting.

- Momentum-Based Scalping: This strategy seeks to capitalize on short, intense bursts of directional price movement (market momentum). Essentially, the goal is to quickly enter when momentum picks up and exit before it fades.

- Support and Resistance Scalping (Range/Reversal): Here, the approach identifies significant short-term price levels where buying (support zone) or selling (resistance zone) pressure has previously emerged. Scalpers using this method aim to profit from brief bounces or rejections off these established key levels, often anticipating a mean reversion on a micro scale.

- Breakout Scalping: Traders using breakout scalping aim to enter a trade just as the price decisively breaks through a defined level of consolidation, support, or resistance. The aim here is to capture the initial acceleration or sharp move that often follows such a breakout.

- Moving Average (MA) Crossover Scalping: One of the more popular types of scalping strategies for beginners, this technique uses the crossing of two or more short-term Exponential Moving Averages (EMAs) to signal potential shifts in the micro-trend direction.

- News-Based Scalping: An advanced and high-risk approach attempting to profit from the extreme, short-lived volatility immediately following major economic announcements or significant risk events.

Scalping Strategies Comparison

| Strategy Type | Key Indicators Commonly Used | Typical Optimal Timeframes |

| Momentum-Based | RSI, Stochastic, MACD | 1-5 minute charts |

| Support/Resistance | Fibonacci Retracements, Pivot Points | 5-15 minute charts |

| Breakout | Bollinger Bands, ATR, Volume | 1-3 minute charts |

| Moving Average Cross | EMA (e.g., 5, 10, 20 periods) | 3-10 minute charts |

| News-Based | Economic Calendar | Seconds to minutes around news |

Note: Leveraged restricts trading 5 mins before/after high-impact news, so this strategy is generally not viable within their framework, reinforcing the importance of understanding a prop firm's specific rules.

Scalping Strategy Selector

Find the perfect scalping strategy that matches your personality, schedule, and risk tolerance. Answer a few questions to get your personalized recommendation.

Question 1

How much time can you dedicate to trading each day?

Question 2

How do you handle high-pressure decisions?

Question 3

What's your preferred trade duration?

Question 4

How do you feel about risk?

Question 5

What market conditions do you prefer trading in?

Question 6

How do you prefer to identify trading opportunities?

Question 7

What's your typical emotional response to a losing trade?

Question 8

How important is technological/analytical setup to you?

Your Ideal Scalping Strategy

Secondary Match:

Ready to put your strategy into action?

Transform your scalping knowledge into tangible results. The Leveraged simulation is your opportunity to prove you have what it takes to become a funded trader.

Pros and Cons of Scalping

Scalping offers several unique benefits that make it appealing to certain trader profiles but despite its appeal, profitable scalping comes with significant challenges too.

Let’s break them down…

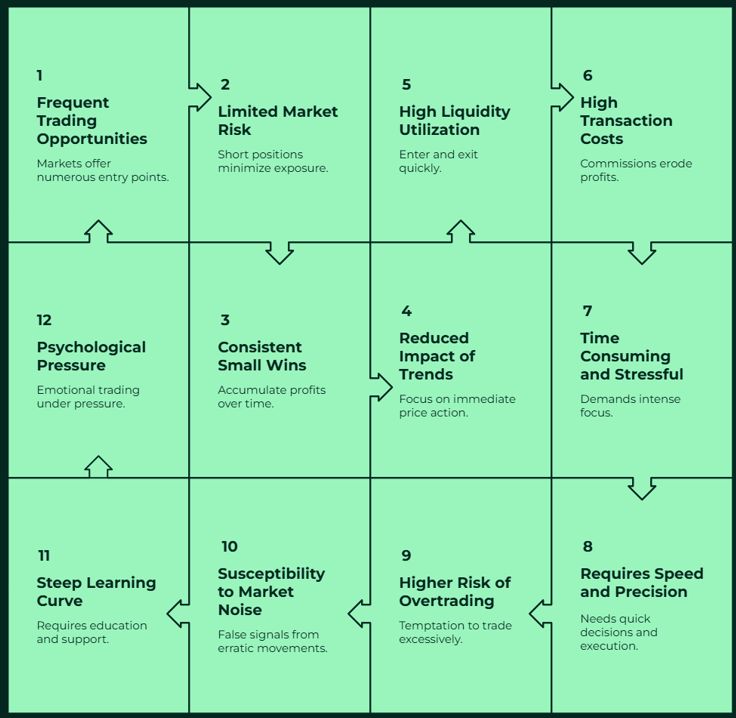

Why Traders Choose a Scalping Strategy (Pros)

- Frequent Trading Opportunities: Markets constantly fluctuate, providing numerous potential entry points throughout the day for scalpers. Therefore, you don't need to wait long for setups.

- Limited Market Risk Per Trade: Because positions are held for extremely short holding periods, exposure to adverse overnight news or significant broader market swings is minimized.

- Potential for Consistent Small Wins: The goal is to accumulate many small profits, which can lead to consistent wins and potentially substantial gains over time if executed well.

- Reduced Impact of Larger Trends: Scalpers can potentially profit whether the market is trending strongly or moving sideways, as they focus on immediate price action.

- Suitability for Automation: The rule-based nature of many scalping techniques makes them well-suited for automation tools and algorithmic systems (though this is typically more advanced).

- High Liquidity Utilization: Scalping thrives in highly liquid markets, taking advantage of the ability to enter and exit quickly.

The Challenges and Risks of Scalping (Cons)

- High Transaction Costs: Commissions and bid-ask spreads are incurred on every trade. Due to the high trade frequency, these trading costs can significantly erode profits, making small profit margins even smaller.

- Time Consuming and Stressful: Scalping demands intense focus and constant monitoring during active market hours. This trading style can be mentally exhausting and stressful. Additionally, it also requires significant screen time. Therefore, it may not suit everyone.

- Requires Speed and Precision: Needs low-latency internet, a robust platform, and the ability to make quick decisions and execute trades flawlessly (rapid order execution). Moreover, technical glitches or slow trade execution can be costly. Slippage is a constant concern.

- Higher Risk of Overtrading: The abundance of potential (but not always valid) signals can tempt traders into overtrading, leading to unnecessary losses and increased costs.

- Susceptibility to Market Noise: Short-term price movements can be erratic and driven by random fluctuations (market noise) rather than clear patterns, leading to false signals.

- Steep Learning Curve: This is why a supportive environment can be beneficial. For example, prop firms like Leveraged often provide educational resources (courses, webinars), community support (Discord), and even AI-powered tools to help traders navigate this curve.

- Psychological Pressure: The need for constant quick decisions under pressure can lead to trading on emotion (fear, greed, revenge trading), deviating from the plan. However, the structured rules of prop firm challenges can actually help mitigate this by enforcing discipline.

Real Case Study: $500 to $600 in One Hour Using a Scalping Setup

“Alex” starts a trading session with $500, aiming to grow the account using a disciplined 1-minute scalping strategy.

Alex's scalping setup:

- Market & Timeframe: EUR/USD (assuming high liquidity & tight spreads) on the 1-Minute Chart.

- Strategy: A basic 5/10 EMA Crossover scalping technique.

- Risk Management: Strict 1% capital risk ($5) per trade, enforced with tight stop-losses. Position size adjusted accordingly.

Over the next hour, Alex executes seven rapid trades based predominantly on the EMA crossover signals:

- Acting on Signals: An early bullish crossover (5 EMA above 10 EMA) prompts a BUY at 1.0750. The pre-set profit target at 1.0758 (+8 pips) is hit quickly.

- Disciplined Loss Taking: Later, a bearish crossover signal leads to a SELL at 1.0755. Unfortunately, price moves slightly against the position, hitting the mandatory tight stop-loss at 1.0760 for a controlled -5 pip loss. Alex accepts the loss without hesitation.

- Capturing Momentum: Subsequent valid signals, including another bullish crossover and a breakout confirmation, allow Alex to capture further small profits, such as two separate +10 pip gains.

- Consistency: Despite two small losses (-5 pips each), Alex sticks to the plan, resulting in five winning trades (+8, +10, +8, +10, +8 pips) during this hypothetical hour.

Hypothetical Result:

- Net Gain: The sequence yields a total net gain of 34 pips (54 pips from wins - 10 pips from losses).

- Monetary Outcome: Assuming a position size where each pip is worth ~$3 (requiring significant leverage and precise sizing on a $500 account), this translates to a gross profit of 34 pips * $3/pip = $102.

- Final Account (Illustrative): $500 (start) + $102 (gross profit) = $602.

Again, this is a highly idealized scenario. Firstly, real-world trading costs would reduce the net profit. Secondly, slippage could negatively impact entry/exit prices. Furthermore, achieving this on personal capital would require a substantial starting amount or extremely high leverage, magnifying risk. However, trading within a structured prop firm environment like Leveraged, while still demanding, provides a framework with defined risk limits (like the 4% daily and 10% max drawdown rules in the Senior Portfolio Manager challenge) designed to protect the firm's capital and enforce trader discipline, preventing catastrophic single-session losses.

Common Mistakes to Avoid and Pro Tips for Scalping

Mastering the art of the scalping strategy involves not just learning techniques but also actively avoiding common traps that derail many novice traders. Here’s a breakdown of frequent mistakes and the professional approach to take instead:

Mistake 1: Ignoring the Impact of Trading Costs

Beginners often focus solely on price movement and forget that every single trade incurs costs – commissions and the bid-ask spread. These transaction costs add up incredibly fast, eating significantly into small profit margins and potentially turning winning trades into net losers.

Pro Tip: Always factor expected costs into your profit targets. For example, 5-pip gross target might require price to move 6 or 7 pips in your favor, depending on the fees you’re paying. Therefore, select a reliable broker or prop firm specifically known for competitive pricing for active traders – meaning consistently tight spreads and low commissions.

Mistake 2: Neglecting Risk Management

Feeling the pressure of rapid trades, beginners might forget to set a stop-loss, use excessively large position sizes hoping for a quick score, or worse, widen their stop-loss when a trade goes against them, hoping it will turn around. This is a recipe for disaster in scalping.

Pro Tip: Every single trade must have a pre-defined, tight stop-loss placed immediately upon entry. No exceptions. Additionally, before trading, determine the maximum percentage of your capital you'll risk per trade (e.g., 0.5% - 1%).

Mistake #3: Letting Emotions Dictate Decisions

The speed and intensity of scalping can easily trigger emotional responses. For instance, fear might cause hesitation on valid entries, greed might lead to holding winners too long (only for them to reverse), and anger after a losing trade can lead to impulsive "revenge trading." Trading on emotion destroys discipline.

Pro Tip: Establish realistic daily targets for profit and maximum loss. Once either is hit, stop trading for the day to avoid emotional decisions. Also, limit trading time if focus wanes.

So, Is a Scalping Strategy Right for You?

After exploring the mechanics, strategies, pros, cons, and demands of scalping, the crucial question remains: is this scalping strategy suitable for you? Consider these factors honestly:

- Personality and Mindset: Can you handle high stress? Are you disciplined, focused, patient yet decisive? Can you make quick decisions under pressure and accept frequent small losses without becoming emotional? Scalping requires a specific temperament.

- Time Commitment: Do you have several hours available during active market hours to dedicate solely to scalp trading?

- Risk Tolerance: While risk per trade is small, the potential for rapid losses due to overtrading or a string of bad trades exists. You need to be comfortable with the fast-paced nature and the risks amplified by potential leverage.

- Technical Skills and Learning Curve: Are you willing to put in the effort to learn technical analysis, master a trading platform, understand market microstructures, and navigate the steep learning curve?

- Trading Capital and Costs: Do you have sufficient capital to trade meaningful position sizes (even with leverage) and absorb transaction costs? This is where prop trading firms like Leveraged offer a compelling alternative. If you pass the evaluation (Leveraged's multi-phase simulations with clear profit targets and risk rules), then you can trade the firm's capital (from $10K up to $1M across different Leveraged programs), keeping a large share (Leveraged offers an 80% profit split) of the profits without risking your own money.

If you thrive under pressure, enjoy intense focus, possess strong discipline, and are committed to continuous learning and practice, scalping might be a viable path. If you prefer a slower pace, less screen time, or are easily stressed by rapid fluctuations, other trading styles like swing trading or trend following might be a better fit.

Final Words

The scalping strategy offers an enticing path for traders seeking frequent opportunities and the potential for substantial gains through the accumulation of small, consistent profits from rapid trades. Ultimately, success hinges less on finding a secret indicator and more on mastering the fundamentals: a well-conceived trading strategy, flawless trade execution, unwavering discipline, and above all, rigorous risk management.

As a beginner exploring scalping for beginners, focus on understanding one or two of the more technical, rule-based strategies like MA Crossovers or Support/Resistance bounces first.

Practice diligently, perhaps even within the structured environment of a prop firm simulation. If you believe you have the potential and discipline required for scalping, but lack the necessary starting capital, demonstrating your skills through a prop firm challenge could be your next logical step. Successfully navigating such an evaluation proves your ability to manage risk (like adhering to daily and max drawdown limits) and generate profit consistently (hitting defined profit targets) – key attributes Leveraged seeks in its future Portfolio Managers. Click the button below and start today.

FAQ

Which strategy is best for scalping?

There's no single "best" scalping strategy that guarantees success for everyone. Popular methods include momentum scalping, breakout scalping, and using moving average crossovers.

What is the 1-minute scalping rule?

The 1-minute scalping strategy refers to a style of scalping that heavily utilizes the 1-minute chart timeframe for identifying entry and exit signals for rapid trades. This approach demands extremely fast decision-making, precise trade execution, and unwavering adherence to pre-set rules.

Is scalping really profitable?

Yes, scalping strategy can be profitable for skilled and disciplined traders, allowing for the accumulation of consistent wins from small price movements.

Is Scalping Good for Beginners?

Yes, scalping can be a good starting point for focused and disciplined beginners. Even though it’s challenging, it teaches strong risk management by using small price targets and tight stop-losses, which helps keep losses under control.